Non-energy private sector continues to expand rapidly at end of 2021

Purchasing Managers’ Index™ (PMI™) survey data from Qatar Financial Centre (QFC) continued to signal rapid growth in the non-energy private sector in December. The rates of expansion in total activity, new work and outstanding business all eased slightly compared with November's records, but were still among the fastest registered throughout the near five-year history of the survey. Promisingly for business conditions going into 2022, employment increased at the fastest rate in six months and companies raised their charges at the second-fastest pace on record.

The Qatar PMI indices are compiled from survey responses from a panel of around 450 private sector companies. The panel covers the manufacturing, construction, wholesale, retail, and services sectors, and reflects the structure of the non-energy economy according to official national accounts data.

The headline IHS Markit Qatar PMI is a composite single-figure indicator of non-energy private sector performance. It is derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

The PMI remained well into expansionary territory at 61.4. This was slightly lower than November's record high of 63.1, ending an unprecedented run of six month-on-month increases. But the latest figure was still the third-highest since the survey began in April 2017.

The two largest components of the PMI by weight – new orders and output – were behind the month-on-month dip in the headline figure in December. Both sub-indices registered three-month lows but were nonetheless the fourth-highest on record and therefore indicative of rapid growth rates in both total and new business at the end of 2021. Activity levels of firms remained well above the norm observed over the past five years. The construction sector registered the strongest increases in both activity and new work in December. The three remaining, and less weighty, component sub-indices – employment, suppliers' delivery times and stocks of purchases – all had positive directional influences in December, compared with November.

With demand for their goods and services rising rapidly in December, non-energy private sector firms in Qatar increased their workforces. Employment increased for the fifteenth successive month – a survey-record sequence – and at the fastest rate since June. Gains were broad-based across the four main sectors monitored, led by wholesale & retail.

Faster growth in workforces was insufficient to prevent another build-up in outstanding business in December, a sign of rising pressure on capacity. Backlogs rose for the fifteenth month running, and at the third-fastest rate on record. The strongest rise in outstanding business was registered at service providers.

Companies boosted their purchasing activity again in December to support business operations, with the latest increase the fourth-strongest on record. This placed additional pressure on suppliers, whose delivery times lengthened over the month for the first time since March. The level of stocked inputs rose for the seventh consecutive month, and at the fastest rate since September.

Average input prices rose for the fifth month running in December, at a rate which remained above the near five-year survey trend. Companies again passed on greater costs to customers in the form of higher charges, with the rate of output price inflation the second-fastest on record.

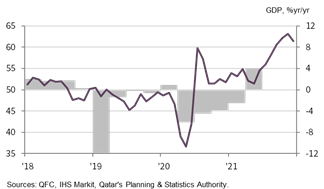

QFC Qatar PMI™ vs. GDP

Financial sector maintains rapid growth at end of 2021

- Growth rates for activity and new business ease, but remain elevated

- Faster increase in employment at financial firms

- Prices charged for financial services fall slightly

The latest PMI data on Qatar's financial services sector signalled further marked growth in December. Business activity increased more slowly than in October and November, but still at the third-fastest pace since the series began in 2017. New business growth followed a similar pattern, easing to a three-month low but remaining elevated overall.

Employment at financial services firms rose further, and at a faster rate than in November, while business expectations remained positive.

Average input costs at financial services firms rose solidly for the fourth month running in December, and at a rate sharper than the long-run series trend. In contrast, prices charged for financials services fell slightly, signalling some pressure on profitability.

Comment

"December's PMI ended up posting, 61.4, registering higher average levels than in any previous period since the survey began in April 2017 throughout the fourth quarter. Outside what has been registered over Q4, the next-highest PMI reading was the post-lockdown bounce to 59.8 in July 2020.

"The recent data point to a booming non-energy private sector economy, and a further acceleration in official year-on-year economic growth in the fourth quarter. The most recent GDP figures show a 4% annual expansion in the second quarter, when the PMI averaged 52.7. Since then, the PMI has risen sharply to 58.2 in the third quarter and 62.3 in the final quarter.

"Firms also remained positive regarding the outlook for 2022, linked to business opportunities arising from the FIFA World Cup and new regional markets opening up to its products. December data suggests firms remain bullish on pricing, with charges levied for goods and services rising strongly again."

Yousuf Mohamed Al-Jaida

Chief Executive Officer, QFC Authority

Contrast View

Contrast View

Increase Text

Increase Text

Decrease Text

Decrease Text

Reset Text

Reset Text