Non-energy growth hits new survey peak in November

Purchasing Managers’ Index™ (PMI™) survey data from Qatar Financial Centre (QFC) scaled new heights in November, signalling a burgeoning non-energy private sector economy. Both total activity and new business rose at the strongest rates since the survey began in April 2017, while a record rise in backlogged work suggested growing capacity pressures despite a further rise in employment. Moreover, pricing power improved as average charges for goods and services increased at a series-record pace during November.

The Qatar PMI indices are compiled from survey responses from a panel of around 450 private sector companies. The panel covers the manufacturing, construction, wholesale, retail, and services sectors, and reflects the structure of the non-energy economy according to official national accounts data.

The headline IHS Markit Qatar PMI is a composite single-figure indicator of non-energy private sector performance. It is derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

The PMI set a new record high for the third month running at 63.1 in November, up from 62.2 in October. This indicated the strongest overall improvement in non-energy business conditions since the survey began in April 2017. The headline figure has risen for the past six months, a record sequence of month-on-month gains.

The latest rise in the PMI was driven by the new orders and output components, which together have a weight of 55% in the headline figure. Both indicators set new record highs during the month, most notably new business, with 54% of companies reporting stronger demand growth during November. In contrast, only 2% of firms reported lower new orders during the month compared with October. Growth rates for output and new work have accelerated continuously since June. Firms linked growth to healthy trading conditions, a lack of COVID restrictions and high levels of customer satisfaction as well as retention.

Qatari firms remained confident of growth in activity from current levels in 12 months' time, partly linked to increased tourism and business opportunities due to the forthcoming FIFA World Cup. Sentiment was strongest in the services and construction sectors.

Employment in the non-energy private sector rose for the fourteenth successive month in November, and at a stronger rate. Despite the pick-up in hiring activity, the level of outstanding business increased at the fastest rate on record. This suggested growing pressure from demand on business capacity.

Purchasing activity was stepped up to meet rising demand in November. The volume of inputs bought rose at the second-fastest rate on record, surpassed only by the bounce registered in July 2020. Stocked inputs rose for the sixth month running. Average purchase prices increased at the fastest rate since June, contributing to the strongest overall cost pressures since August 2020. Wages and salaries also continued to rise, albeit at a slower rate.

With growing pressure on costs and rapidly improving demand, non-energy private sector firms raised their charges for goods and services in November. Moreover, the rate of inflation accelerated to a survey record high, signalling an improvement in profitability.

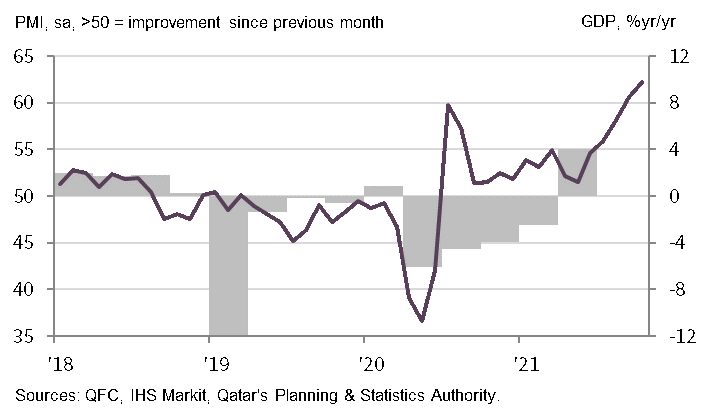

QFC Qatar PMI™ vs. GDP

Marked growth in financial services activity sustained

- PMI data focusing on financial sector indicate marked growth

- New business expands at second-fastest rate to date

- Strongest increase in charges since February 2020

November data covering Qatar's financial services sector signalled another substantial increase in business activity. The rate of growth eased slightly from October but was the second-fastest since the series began in 2017.

New business inflows at financial services firms rose further in November. Growth was the second strongest ever, with only July 2020 having recorded a faster increase over the survey history. Expectations for activity over the next 12 months remained positive, leading workforces to be expanded further.

Average input costs rose further, albeit at a slightly softer rate. Meanwhile charges levied for financial services rose the most since February 2020, signalling improved profitability.

"The latest PMI survey results for Qatar have shown the non-energy economy going from strength to strength as we approach a World Cup year. The PMI set a record high for the third month running in November, backed by surging levels of new business and total activity, which is indicative of the strong, gradual economic recovery being witnessed in Qatar.

"Moreover, the level of outstanding business at companies increased at a record pace during November, despite a faster increase in employment. This bodes well for sustained growth over the coming months.

"Companies also raised their prices charged for goods and services at a record pace in the latest survey, encouraged by strong demand but also in response to greater costs.

"The records set by the PMI in recent months are strongly pointing towards an acceleration in the official GDP figures in the third and fourth quarters, though this partly reflects low base effects from 2020."

Yousuf Mohamed Al-Jaida, Chief Executive Officer, QFC Authority

Contrast View

Contrast View

Increase Text

Increase Text

Decrease Text

Decrease Text

Reset Text

Reset Text