Qatar PMI hits all-time record high in September

The latest Purchasing Managers’ Index™ (PMI™) survey data from Qatar Financial Centre signalled a record improvement in operating conditions in the non-energy economy this September. Output, new orders and purchasing activity all rose at the second-fastest rates on record, while backlogs accumulated at a faster pace despite a sharper rise in employment. Survey data also indicated the strongest 12-month outlook for nearly a year, amidst growing wage pressures and other immediate capacity concerns.

The Qatar PMI indices are compiled from survey responses from a panel of nearly 400 private sector companies. The panel covers the manufacturing, construction, wholesale, retail, and services sectors, and reflects the structure of the non-energy economy according to official national accounts data.

The headline IHS Markit Qatar PMI is a composite single-figure indicator of non-energy private sector performance. It is derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

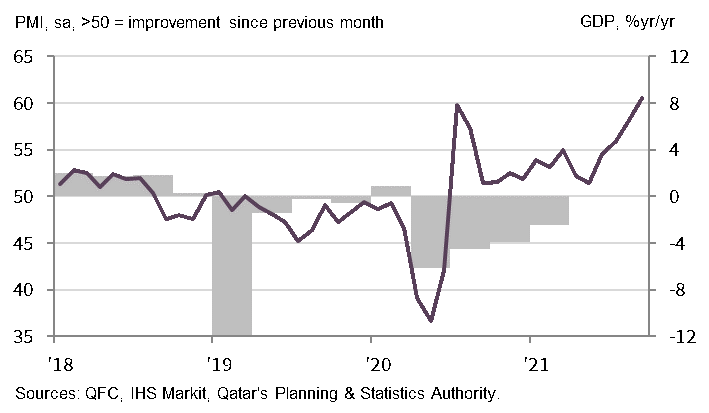

The PMI rose for the fourth month running to 60.6 in September, from 58.2 in August. The latest figure signalled the strongest overall improvement in operating conditions since the survey began in April 2017, surpassing the previous record high of 59.8 in July 2020. Business conditions have improved for 15 successive months, the longest sequence in the survey’s history.

On a quarterly basis, the PMI averaged 58.2 in the third quarter, the highest on record. The previous quarterly peak was 56.2 in the third quarter of 2020 as the economy rebounded from lockdown.

Sub-sector data signalled marked growth across all four main categories. Manufacturing registered the strongest performance in September, followed by services, wholesale & retail, and construction, respectively.

The headline PMI was positively influenced by four of its five components in September. The 2.4-point upward movement in the PMI since July mainly reflected the new orders (+1.3) and output (+1.1) components, followed by employment (+0.2) and stocks of purchases (+0.2). The suppliers' delivery times component weighed slightly on the headline figure (-0.3) in the latest period.

New business growth accelerated for an unprecedented fourth successive month in September, with the overall pace of expansion almost matching the record high set in July 2020 when the economy rebounded with the unlocking of coronavirus restrictions. New business rose particularly strongly at services firms, followed by manufacturing.

A similar trend was evident for total business activity, growth of which quickened for the fourth month running to the second strongest on record. Meanwhile, the volume of outstanding business rose for the twelfth straight month, and at one of the fastest rates indicated by the survey to date. This occurred despite investment in workforces, with non-energy employment rising at one of the fastest rates in the survey history in September, and the strongest wage inflation since February 2019. Qatari firms were increasingly confident of growth over the next 12 months. Business expectations were the highest since October 2020.

QFC Qatar PMI vs. GDP

Comment

“The recent strength in the PMI strongly indicates that overall economic growth will rebound in the second and third quarters, showing that Qatar’s economy is on the path to strong recovery after facing a relatively challenging period brought about by the COVID-19 pandemic. Qatar’s comprehensive set of measures to ensure that the economy is shielded from the adverse effects of the pandemic continue to contribute to the strength we currently witness.

"Qatar's non-energy private sector economy continued to take off in September, with the PMI ascending to a new all-time high of 60.6 The latest figure signals even stronger growth than that registered during the post-lockdown bounce last July, when the PMI peaked at 59.8.

"Although the rates of expansion in total activity and new business did not quite reach their previous records, they were nonetheless the second-fastest in the survey history, as was the increase in buying activity. The rate of workforce growth was among the strongest registered in four-and-a-half years of data collection, with companies also boosting wages and salaries.”

Sheikha Alanoud bint Hamad Al-Thani,

Deputy CEO & Chief Business Officer, QFC Authority

Contrast View

Contrast View

Increase Text

Increase Text

Decrease Text

Decrease Text

Reset Text

Reset Text