Recovery in Qatari non-energy economy continues in September

The non-energy private sector economy of Qatar continued to expand in September as coronavirus-related restrictions were lifted further, according to the latest Purchasing Managers’ Index™ (PMI™) survey data. Output and new business continued to register growth as firms reported operations returning to normality following the lockdown, and the reopening of industrial areas.

The Qatar PMI indices are compiled from survey responses from a panel of around 400 private sector companies. The panel covers the manufacturing, construction, wholesale, retail, and services sectors, and reflects the structure of the non-energy economy according to official national accounts data.

The topline PMI registered 51.4 in September, down from 57.3 in August. The latest figure signalled sustained improvement in business conditions in the non-energy private sector segment of the economy and was the third-highest figure in over two years. Since the survey began in April 2017, the PMI has trended at 49.5. By contrast, over the third quarter of 2020 the PMI averaged a more elevated 56.2. This was by far the highest quarterly average to date, compared with the next-highest figure of 53.5 set in Q4 2017.

At the sub-sector level, the strongest-performing area in the third quarter was wholesale & retail (58.4), followed by construction (57.7), manufacturing (57.6) and services (52.1).

Economic conditions continued to register strong expansion, albeit at a more moderate pace. Month-on-month growth rates for output and new business both eased further in September following record expansions in July, but the respective indices remained among the highest on record. The new orders index was the joint-third highest to date.

The employment index rose to a six-month high in September and was running in line with its long-run average, indicating a stable trend in workforces. Firms also supported workloads by increasing their purchasing activity further, though this was insufficient to prevent a decline in input inventories.

September data also indicated a further improvement in suppliers' delivery times and lower average input prices following July's record inflation. Prices charged fell for the first time in three months, signalling a return to normality.

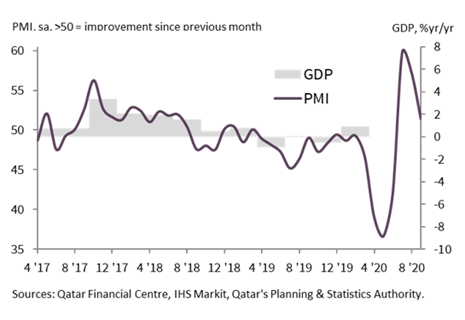

The monthly PMI can be aggregated to a quarterly average to enable comparisons with official gross domestic product (GDP). Since the survey began in April 2017 the quarterly PMI has a correlation of 0.88 with the year-on-year percentage change in GDP in real terms, with a PMI reading of 50.0 equating to 1.0% growth on an annual basis. The latest official data reported annual growth of 0.9% in the first quarter. The PMI data for the second quarter of 2020 are indicating a decline in GDP of 4.6% year-on-year, reflecting the impact of the lockdown on the economy. PMI data for the third quarter are signalling a subsequent rebound, with growth of 4.3%.

QFC Qatar PMI™ vs. GDP

PMI survey data for the third quarter are signalling a strong rebound of the Qatari economy as lockdown measures introduced to fight COVID-19 have been loosened moving through the second half of 2020. The recent trend in the data are consistent with a decline in GDP of 4.6% in the second quarter, followed by a strong rebound of 4.3% in the third quarter.

Sheikha Alanoud bint Hamad Al-Thani, Managing Director Business Development, QFC Authority

Contrast View

Contrast View

Increase Text

Increase Text

Decrease Text

Decrease Text

Reset Text

Reset Text