Post Registration Compliance Requirements for QFC Firms

A licensed firm should adopt a policy of establishing a compliance function in order to maintain compliance with the applicable rules and regulations. The major compliance areas are as follows:

Control

A licensed firm must provide information on holders of controlling interests, in the form and manner required by the QFCA and establish and maintain systems and controls and monitor changes in control.

Registered Functions

A licensed firm must have one individual to carry on the following registered functions: a Senior Executive function; if applicable, the Money Laundering Reporting Officer and the Designated Representative function and provide details of the same to the QFCA.

Scope of License (SoL)

A licensed firm shall conduct its activities fully in accordance with and subject to the conditions provided in the Scope of License issued to the firm by QFCA. When in doubt, the firm must contact the QFCA for clarification, and should avoid breaching the terms of the SoL. If required, a firm can apply to amend their SoL.

Companies Registration Office (“CRO”) Filings

QFC firms are required to make certain submissions to the Companies Registration Office (CRO), in accordance with the applicable regulations.

Annual Filings

1. Annual Return

The Annual Return is a mandatory filing that must be submitted to the CRO annually. It is, essentially, a confirmation that the corporate information of your firm held by the CRO is accurate. This submission also gives you the opportunity to update your firm’s information and notify changes if any missed out to notify to the CRO, in time.

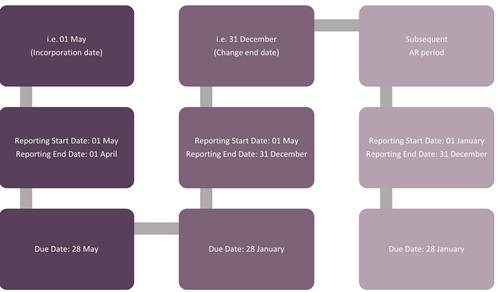

Your Annual Return becomes due for filing on the anniversary date of the firm’s incorporation, every year. Should your firm wish to change its Annual Reporting Period, you can select another date through Client Portal. The date so selected will thereafter become your firm’s new due date for Annual Returns.

Time limit: To be filed within 28 days after the Reporting End Date in the AR Annual Return.

There is a filing fee of $200 (or $50 for LLC(G)s and Foundations) and can be paid online.

Click here to watch a short video on filing your Annual Return

2. Financial Statement (Accounts)

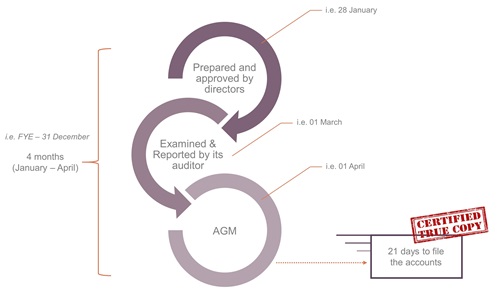

Financial Statements are required to be filed in compliance with the applicable regulations. The Reporting Period for audited Financial Statements is your firm’s Financial Year as notified to the CRO.

Steps for filing will vary depending on your legal structure as a company.

Time limits: 21 days from the approval of the General Meeting of the members for LLCs; and 21 days from the approval by members for LLPs.

There is no fee for this filing and these filings can easily be done through Client Portal.

LLC(G)s are also required to prepare and submit the Accounts to the CRO within 21 days of the approval of the General Meeting of the members, however, they are not required to be audited.

Click here to watch a short video on submitting your Annual Financial Statement

Exemption from the requirement to file Accounts (Financial Statements) or Annual Returns.

All Special Purpose Companies, and Holding Companies which are passive in relation to their approved permitted activities or which are fully owned by the Government of the State of Qatar, are exempted from the requirements of submitting Accounts (Financial Statements) or Annual Returns to the CRO, unless specifically asked by the CRO or the QFCA.

3. Annual UBO (Ultimate Beneficial Ownership)

Reports

All QFC Firm are required to submit their Annual UBO Reports to the CRO, with details of all their Beneficial Ownership, and particulars of their Nominee Shareholders, Nominee Directors, and Directors which are body corporates. The Annual UBO Reports shall become due from the date specified by the CRO, and shall be filed within 30 days from that date.

Ad-hoc or Event Driven Filings

When changes take place in your firm’s corporate details earlier submitted to the CRO, you are required to notify the CRO in a time bound manner.

The Companies Regulations require numerous event driven filings (non-exhaustive), the most common are Change of Director, Change of Secretary, Change of Registered Office etc.

Time limits can also vary according to the specific event, but generally, you should submit your ad-hoc filing to the CRO within 21 days of your firm’s change of circumstances.

Our fees vary but are typically around $200 dollars per notification.

Click here to watch a short video on Ad-hoc filings

Waiver/Modification or How to Avoid Breaches

Where the timelines for a filing cannot be met for justifiable reasons, you can make an extension of time request to the QFCA. This needs to be filed through Client Portal, with a supporting document from a third party corroborating the reasons provided for the extension request.

The CRO will review any such application on its merits and revert back to the firm with the QFCA’s decision.

Contrast View

Contrast View

Increase Text

Increase Text

Decrease Text

Decrease Text

Reset Text

Reset Text