North Field Expansion’s Economic Implications for Qatar Beyond LNG

It’s official: Qatar Petroleum (QP)’s North Field expansion is moving forward. The North Field East expansion (NFE) is another milestone in Qatar’s economic development journey, which will usher in ample new business opportunities both direct and indirect. Instatement of the largest single LNG project sanctioned in history, and likely the largest one across the global upstream business in 2021, has been initiated with QP’s recent award of key onshore EPC work worth at least $13 bn to the Chiyoda Technip joint venture (CTJV). The project also reflects Qatar’s and QP’s embrace of global efforts to combat climate change, ushering in environmental efforts and specialised associated professional services that themselves will marshal in new commercial opportunities for the country moving forward. Whereas the expansion of LNG export capacity itself will help to green world energy production as it transitions from coal, a variety of other promising business-related possibilities await. As Qatar looks ahead, it is destined to leverage its natural gas-focused competitive cost advantages, global network, existing industrial base, innovative focus and high-profile investments to become an attractive and rewarding business destination. QFC plays a key part of the country’s development journey, which it looks forward to supporting with vigor and indirectly offering firms on its platform noteworthy prospects.

NFE Expansion – The Basics

Qatar’s LNG expansion is of global consequence. HE Minister of State for Energy Affairs and QP CEO Saad al-Kaabi recently made a series of announcements that outline two certain and cogitated additional phases of the North Field expansion. The first certain phase concerns the North Field East (NFE) that comprises an approximate $28.75 bn of investments –half of which has received a final investment decision as of February 2021. Beyond that, QP is appraising different areas of the North Field to possibly award a subsequent expansion phase within the next three years.

The recent NFE award concerns onshore EPC work, while the train partner awards are expected before end of 2021. Tender winner CTJV will proceed with construction of four 8 mn t/y liquefaction trains at Ras Laffan to raise Qatar’s total capacity from 77 mn t/y to 110 mn t/y. First gas from the expansion project is scheduled for Q4 2025, with the startup of each of the NFE trains to be staggered by 3 to 6 months. In tandem, under QP’s Sustainability Strategy, the firm will install carbon capture and storage (CCS) facilities with a record capacity of 7-9 mn t/y and procure electricity from both Siraj-Marubeni-Total’s Al Kharsaah 800MW solar PV plant and a second 800MW solar plant to-be-constructed soon. These novel investments and energy sources will facilitate future export potential of energy products with technologies only now being developed.

QP has made this NFE investment at an opportune time, which will allow it to capture more global LNG market share and gain footholds in new markets as many competitors pull back from major projects. Only one small LNG project worldwide gained a final investment decision in 2020, while plants with aggregate capacity of 74 mn tons were deferred amounting to $70 bn in investments. As of early 2021, Qatar committed to the North Field expansion to reinforce its competitive advantage in LNG as well as enlarge its worldwide market share and impact. Qatar is the world’s most efficient producer, and by entering North Field expansion phases ensures its economies of scale continue to build.

The long steadfast determination of QP to proceed with NFE with or without partners has strengthened its hand in negotiations and ensured strategic considerations are addressed in any chosen partnership. Since the lifting of the North Field moratorium in 2017, QP has used its existing partners to obtain non-operating partner stakes in global E&P positions with firms such as Total (9 stakes), ExxonMobil (6), ENI (5) and Shell (3). With the final award now pending in 2021, QP is only likely to agree to tight commercial terms with an independent energy company that will also bring along new captive customers. The partner awards will materialise later this year, under a backdrop of continued strong demand. Rystad Energy recently forecast global LNG demand to grow 60% from 363 mn tons in 2020 to 580 mn tons by 2030.

The economic benefits of NFE beyond LNG

Beyond the immediate investment involved in enlarging LNG capacity, associated GDP gains and the lifting of Qatar’s trade surplus there are three indirect unsung economic benefits that will follow the North Field expansion. First, there are several byproducts that will result in additional export revenues and local manufacturing opportunities. Second, a QFC newcomer will establish its position as a global portfolio manager of spot LNG trades that will have immediate local knock-on effects. Third, recent QP investments will allow Qatar to become a globally cost-competitive in a burgeoning area: blue and green hydrogen.

The NFE project will not only bring up natural gas from underground, but also other valuable hydrocarbons for export and domestic use. Associated hydrocarbons destined for export include 260,000 b/d of condensate and 11,000 t/d of LPG. As compared to 2020-dated total export capacity levels, the increased LFE volumes equal to 65% of condensates and 36.5% of LPG, respectively. Using posted 2020 average prices these associated hydrocarbons would be valued at roughly $ 3.05 bn annually. Additionally, there will be 4,000 t/y of ethane for use as feedstock in Qatar’s growing petrochemicals sector. This hike equates to nearly 50% of existing 2020 export capacity, or 36.4% of current domestic base quantities. A combination of these NFE ethane volumes and those from Barzan enables Qatar to in future produce a greater variety as well as more complex petrochemicals, such as those that will originate from the JV with ChevronPhillips (70% owned by QP) using the Middle East’s largest 1.9 mn t/y ethane cracker in Ras Laffan to start production in 2025. This is critical to the local economy, according to Gulf Petrochemicals & Chemicals Association’s Secretary General, who recently outlined that with oil at $65/b, crude producers can earn $15/b by refining their output and an extra $30/b on top of that by converting it into petrochemicals. As Qatar continues its drive to diversify economically, local manufacturing will play a key role.

The additional income earned through hydrocarbon exports will increasingly make Qatar a destination for asset managers and other financial institutions. As imports of construction inputs and machinery wane with most infrastructure projects coming close to completion, Qatar’s trade surplus is likely to register bigger in the years ahead. Once NFE-related exports commence in late 2025, export earnings are destined to reach still higher. Whereas much of the immediate proceeds are destined to the Ministry of Finance and Qatar Investment Authority, there is a progressively stronger case for specialised asset managers to locate in Doha close to their future investors. In tandem, financial institutions in the country will increasingly be called upon to provide a variety of sophisticated products to Qatari firms with a growing international footprint. As Qatar’s economy continues to grow at home in terms of complexity, and abroad with its varied connections, the financial sector is set to increase substantially.

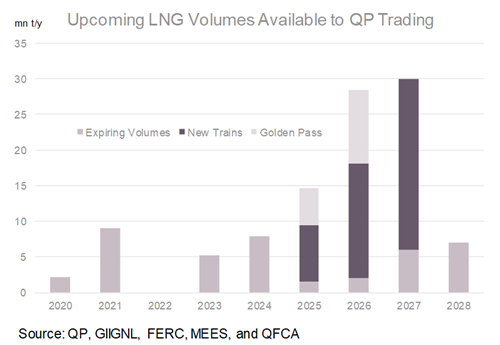

A QFC company, QP Trading, will increasingly be active on the international stage and unlock commercial opportunities to other specialised entities on the platform. QP Trading is set to be an active global portfolio manager of LNG supply and purchase agreements (SPAs) as well as spot trades over the next decade as volumes increasingly become available from both old and new projects. Spot volumes will reach up to 10% of total Qatari LNG volumes sold. According to HE Minister Saad Al Kaabi, QP Trading will be a very focal part of QP’s business and rival oil majors and global trading houses to smooth out price spikes. In late 2020 it struck its first SPA with Temasek-owned Pavilion Energy delivering up to 1.8 mn t/y over 10 years to Singapore that uniquely implemented a green-house gas emissions (GHG) quantification and reporting methodology. The advent of QP Trading’s proposed GHG methodology is particularly important during a time when market clarity on what a ‘carbon neutral’ LNG cargo is non-existent. Although Shell, Tokyo Gas, JERA, ADNOC, Total and CNOOC have been involved in deals for carbon neutral LNG cargoes, of which 7 have been sold in Asia since mid-2019, some of them include total GHG emissions while others focus exclusively on carbon. With QP Trading’s trailblazing methodology calculating GHGs from wellhead to receiving berth, this all-encompassing approach ought to give climate-conscience customers added comfort. As QP Trading’s portfolio and trading activities expand over the decade ahead, specialised QFC service providers ranging from consultancies, financial institutions and law firms will all be asked to play an active part in its development journey.

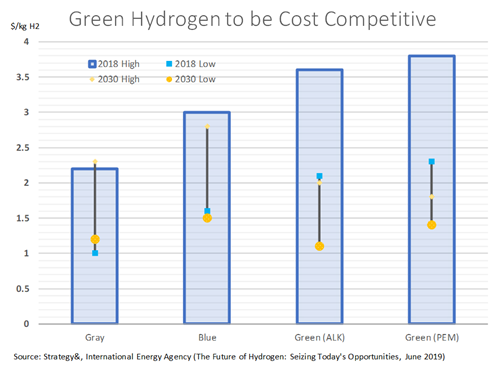

With the kick-off of the FIFA Club World Cup Qatar 2020, the hydrogen revolution arrived early in Doha. In February 2021, a hydrogen fuel cell bus served the event transporting fans as they traveled through the increasingly metropolitan and greening city. Qatar has recently made a variety of environmentally-minded moves, but the most impactful might be one still to come: the production and export of hydrogen. The product idea is not new, with Qatar having considered doing so commercially with the Japanese as far back as 2012. Although past efforts in this area across the Gulf have resulted in only studies, recent global developments and a concrete $5 bn project award for a green hydrogen plant to Air Products-Acwa Power in Saudi Arabia’s NEOM has altered the equation. Concurrently, key Qatari energy customers are committing themselves to become carbon-neutral by 2050, including Japan as of October 2020. The green energy shift affects both wealthy and developing markets almost simultaneously, with most OECD economies targeting 2050 to achieve carbon-neutrality while China itself recently announced their own goal of 2060. Consequently, global energy import preferences are set to change fast. Whereas renewable energy options are set to grow strongly against this backdrop, it will not be enough – and critically are not optimised for heavy industrial activity. Instead, hydrogen has the allure of being: light, storable, reactive, and contains high energy content per unit mass (39.4 kWh/kg, or three times that of traditional liquid hydrocarbons). When combusted, it yields only water. Under current technology, considering the ease and low cost of conversion, ammonia is the preferred method to transport hydrogen across oceans and is increasingly in demand. In mid-February 2021, Japan announced a target of boosting its ammonia demand to 3 mn t/y by 2030 from 0 currently. According to QAMAR Energy in a November 2020-dated study, global demand for green hydrogen could reach 530 mn t/y by 2050 valued at $300 bn per annum. With its recent CCS and solar plant additions, Qatar has the potential to become a key player in this field. While green hydrogen production costs have the potential to become cheaper than blue hydrogen, which is currently more cost-competitive, this is not likely to materialise until the end of the decade. As global hydrogen demand gradually expands, Qatar is likely to focus on reducing long-term domestic hydrogen production costs, reaping efficiency gains by harnessing industrial heat waste in existing complexes and reaching agreements with key climate-conscious customers to export decarbonied industrial goods such as steel, glass and fertilisers (made with blue or green hydrogen). Market demand for decarbonized industrial goods is growing, as evidenced by BMW’s agreement to purchase 43,000 tons of Emirates Global Aluminum’s solar-powered aluminum that cuts the car company’s annual emissions of carbon dioxide by 200,000 tons.

Qatar: Worth Betting On

Qatar’s economy holds significant promise in the years ahead. To quote @Akber Khan’s recent editorial, the State offers “a rarity of uncommon visibility and unusually high growth” prospects. QP has initiated the next economic development chapter of Qatar through its recent investments, enabling a myriad of knock-on commercial opportunities. The NFE will not only materialise substantial LNG and associated hydrocarbons export revenue, but it will also supply an increasingly cost-competitive and sophisticated manufacturing sector. The QFC community will also be a direct beneficiary with the advent of QP Trading’s activities, which will broaden over time as its portfolio enlarges with new projects and expiring volumes. At the same time, QP will continue to explore the potential of blue and green hydrogen as an alternative fuel powering the world’s electricity and industrial sectors as it meets decarbonization targets. Whereas Qatar is already a known quantity in LNG, that may soon too be the case for hydrogen. Qatar’s economy will benefit directly from these and other ongoing developments. With high growth prospects, burgeoning green credentials and the capability to implement innovative world-scale projects Qatar is worth betting on.

Contrast View

Contrast View

Increase Text

Increase Text

Decrease Text

Decrease Text

Reset Text

Reset Text